- Merito

- Posts

- Export or Die

Export or Die

How Indian D2C Brands Must Go Global by ₹25 Crore or Hit Permanent Ceilings

D2C x Global

Hey readers,

Welcome to the Twelfth edition of D2C Cents!

TLDR - We are your scroll-friendly, no-fluff download of what's shaping India's D2C brands.

This edition? We talk about:

Why waiting to go global is actually costing you money

How to pick your first export market (spoiler: it's not always the US)

The sharpest D2C news that matters

Mama Earth did ₹1,500 crore in revenue in India. But their marketing costs stayed at 35-40% of revenue, fighting price wars with 50 other "natural skincare" brands.

Meanwhile, iD Fresh Food started exporting to the Middle East in 2015 when they were still a relatively small brand. Today, the Middle East contributes 25% of its revenue, and with local manufacturing there, they've avoided the margin squeeze that comes from scaling only in India.

Same product, different country, way better economics.

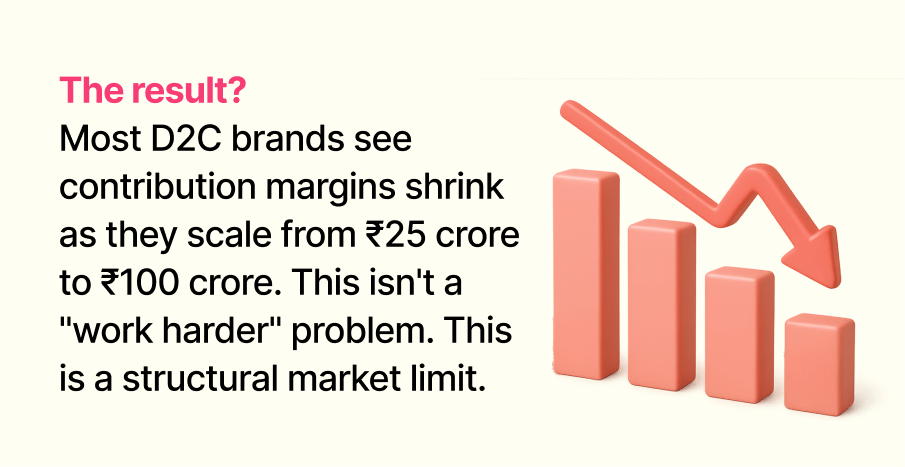

By the time you're doing ₹100 crore in India, your unit economics are probably worse than at ₹25 crore. And if you haven't gone global by then? You're kinda trapped.

Let me show you why.

CAC is exploding. Customer Acquisition Cost for many D2C brands has jumped from ₹400-600 in the early 2020s to ₹750-1,000 in 2024. Why? Everyone's fighting for the same customer on the same Meta and Google ads.

Categories are crowded. Personal care alone has 200+ active D2C brands. In 2019, there were maybe 100. More brands = higher ad costs = lower margins.

Paying customers are limited. Only 80-100 million Indians regularly buy premium D2C products. Spread across 200 brands... you're all fishing in the same pond.

You're spending more to acquire customers who are less loyal because they have 10 other options that look exactly like you.

Here's why you need to start thinking global at ₹25 crore, not ₹100 crore:

1. Your Product-Market Fit is Proven, But Your Team is Still Nimble

At ₹25 crore, you've figured out what works. Your product quality is consistent, you understand your customer, and your supply chain works. But you're small enough to experiment without three approvals.

2. Your India CAC Hasn't Hit the Wall Yet

At ₹25 crore, your blended CAC is probably still manageable - maybe ₹1,000-1,200. You're not yet in the "spend ₹2,000 to acquire a customer worth ₹1,800" trap that happens at scale.

3. Strategic Buyers Care About Geographic Diversification

Remember the HUL-Minimalist deal? One underrated factor: Minimalist had early traction in the Middle East through Noon and Amazon.ae. For HUL - it validated that the brand could travel beyond India.

The Three Markets That Can Hit A Jackpot

Most Indian D2C brands shouldn't start with the US or Europe. Here's where you should look:

Market 1: Middle East (UAE, Saudi Arabia)

Why it works:

Indians are 35% of the UAE population, built on trust

High purchasing power: UAE per capita income is $50,000+ vs India's $2,500

Lower competition than India or the US

English works, no translation needed

UAE e-commerce expected to reach $9.2 billion by 2026, growing at 12.9% CAGR. Beauty and personal care is the fastest-growing.

Compliance heads-up: Most food and wellness products need ESMA (Emirates Authority for Standardization and Metrology) certification. Personal care needs Emirates FDA approval. Allow 2-3 months for approvals. Halal certification isn't mandatory but helps sales significantly

Real example: Lenskart entered the Middle East in 2021 with a $50 million investment commitment. They opened their first store in Dubai Festival City Mall in December 2021. Within 2 years, they expanded to 27 stores across GCC (UAE, Saudi Arabia, Oman, Bahrain) by 2025.

The brand aimed to capture 25% of the region's $3.5 billion eyewear market by 2026.

Market 2: Southeast Asia (Singapore, Malaysia)

Why it works:

Large Indian diaspora (9% Singapore, 7% Malaysia)

High smartphone and e-commerce adoption

Similar climate = less product adaptation

SEA e-commerce projected to reach $230 billion by 2026 with 22% CAGR. Beauty and wellness categories are growing rapidly.

Compliance heads-up: Singapore requires HSA (Health Sciences Authority) registration for cosmetics/supplements, can take 1-2 months. Malaysia needs halal certification from JAKIM for food products.

Good news: ingredient lists and labeling can stay in English for both markets.

Real example: Bombay Shaving Company expanded into the Middle East and Europe, leveraging their personalized grooming kits. Their women's product line now makes up 25% of their business, and they're available on major e-commerce platforms globally.

Market 3: United States (But Only if...)

The US should probably NOT be your first market unless you have a specific advantage. Here's when it makes sense:

Go US if:

You're in Ayurveda/turmeric/"India-origin" wellness

Highly differentiated product without 50 US competitors

Capital for higher CAC (₹2,500-3,500 vs India's ₹1,400)

What works: Don't be generic. Lean INTO Indianness. Position as "Ayurvedic," "Ancient Wellness," "Turmeric-based." Americans pay a premium for exotic wellness with a story.

Compliance heads-up: FDA doesn't pre-approve cosmetics but you're liable for safety. Supplements need NDI (New Dietary Ingredient) notification if using novel ingredients. Food products need FDA facility registration.

Real example:

VAHDAM India started exporting in 2015, now earns 97% of its revenue from international markets. In FY25, they achieved ₹265+ crore in revenue.

They're available in over 7,000 stores across the Walmart in US, Costco in Canada, and the UK. The brand is endorsed by Oprah Winfrey, Ellen DeGeneres, and Mariah Carey.

VAHDAM achieved EBITDA profitability by focusing on high-margin international markets. Their AOV and margins are significantly better in the US/Europe than in domestic India.

Okay, so you're convinced you should export. But how do you actually ship products without it becoming a nightmare?

Option 1: Work with Export-Focused 3PLs

Typical costs: Shipping to the Middle East is ₹150-250 per 500g package. Southeast Asia is ₹180-300. US is ₹350-500.

Your investors' return expectations dictate your business model.

If they want 10x on ₹50 crore (so a ₹500 crore exit), that screams strategic acquisition. If they want ₹2,000 crore exit… IPO math it is. Your company isn’t free to choose, it’s kinda tied to their expectations.

Option 2: Marketplace Fulfillment

If you're selling on Amazon.ae or Noon, use their fulfillment:

Fulfilled by Noon (FBN): You send bulk shipments to Noon's UAE warehouse, and they handle the rest

Amazon Global Selling: You can ship to Amazon UAE warehouses from India

The advantage: Lower per-unit shipping costs, faster delivery, better customer trust.

The Localization Traps to Avoid

Here's where most Indian brands screw up:

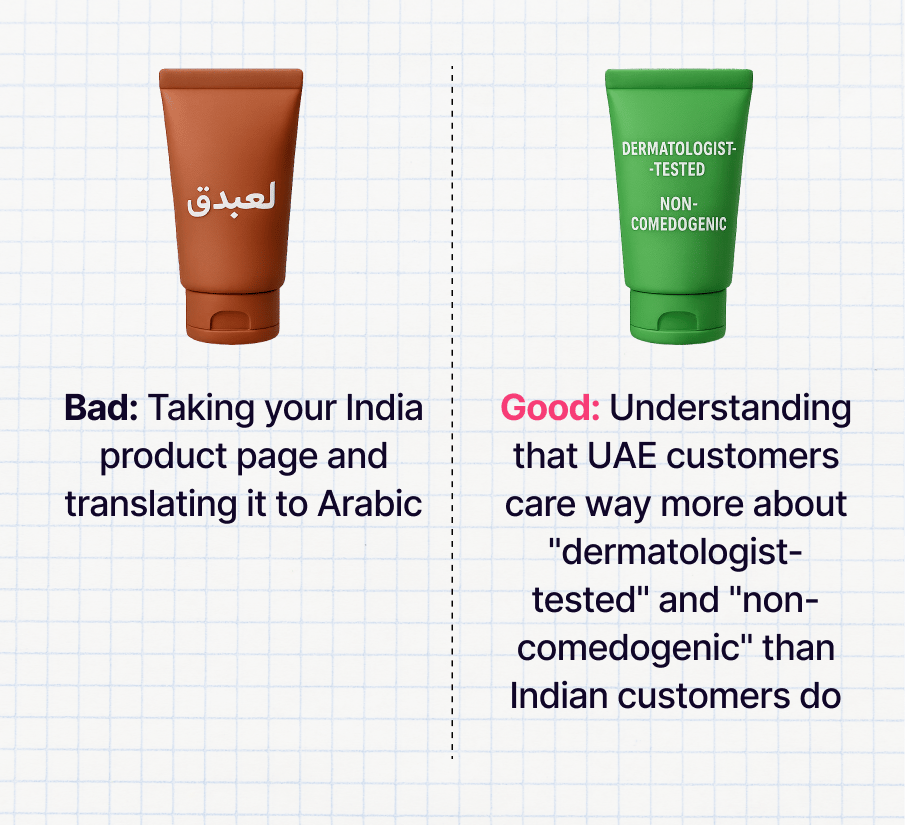

1. Don't just translate, localize

2. Pricing psychology is different

In India, you might sell a face serum at ₹599 and do ₹799 MRP with "33% off!"

In the UAE, constant discounting makes you look cheap. Better to price at AED 49 (₹1,100) and hold the price.

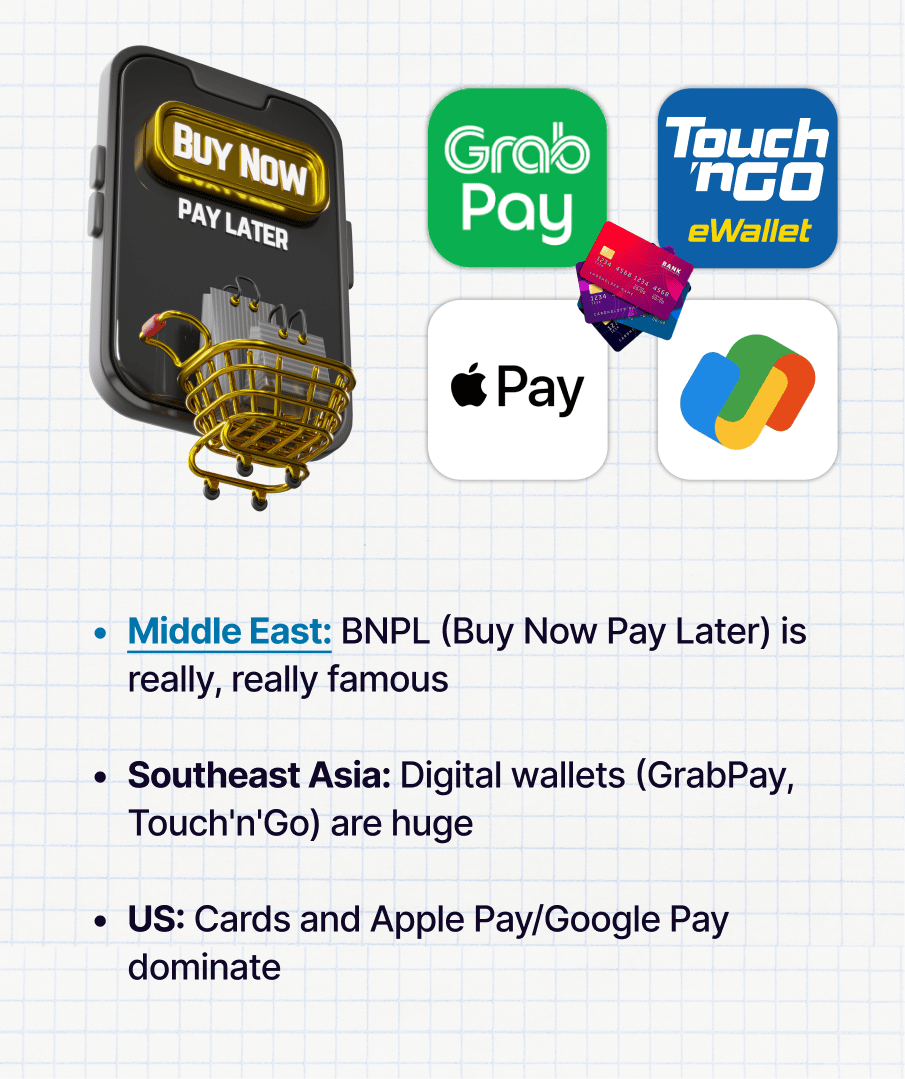

3. Payment methods matter

Make sure your checkout supports local payment methods, or you'll lose 30% of customers at the last step.

4. Customer service hours

If you're only available 9 AM - 6 PM IST, you're missing prime time in the UAE (which is 3.5 hours behind) and completely missing US customers. Either hire for local hours or use chatbots that actually work.

So Should You Go Global Now?

Go global by ₹25 crore if:

India CAC crossed ₹1,200 and is rising

Crowded category (personal care, wellness) with 50+ competitors

Clear "India story" (Ayurveda, natural, traditional)

60%+ gross margins to absorb shipping

₹30-50 lakhs to experiment

Wait if:

Still figuring out fit (sub ₹10 crore)

India's margins are healthy and improving

A category where India is uniquely large

The supply chain is barely holding together

By ₹100 crore, if you haven't gone international, you're probably not going to.

Why? Your entire company is optimized for India. At ₹200 crore, margins are thinner, CAC is higher, and international feels impossible.

The brands that win won't be the ones that grow fastest in India.

They'll be the ones who saw the ceiling coming and built escape routes early.

Ask Yourself

It's not "Should we go global?"

It's "Can we afford NOT to?"

The time to go global is when you don't have to. When you still have options. When ₹25 crore feels exciting, not suffocating.

That time is now.

What do you think? Are you building an India-only business or a global brand that happens to start in India?